TYLER, Texas — The holiday season is known as the most wonderful time of the year -- as families and friends gather round to celebrate the past 12 months. But, it's also peak season for scammers.

Angel Pineda is a traveling nurse who has an account with Chase Bank. He makes major payments, like rent, all the time.

He's used to getting calls from his bank about fraudulent activities on his account -- especially after paying a huge bill like his car payment. But, in mid-December something was off about a call that came from what he thought was a legitimate Chase Bank phone number. Pineda says the call was labeled as a U.S. number under the bank's name.

"So there wasn't any reason for me to suspect anything," said Pineda. "Then I got the notification for fraudulent activity for a small amount and I was like no it's not me."

Pineda says the call was like a fear tactic.

"They were just like your account is not safe, it's compromised," said Pineda. "So we need to make sure your money’s secure and move it to a new account."

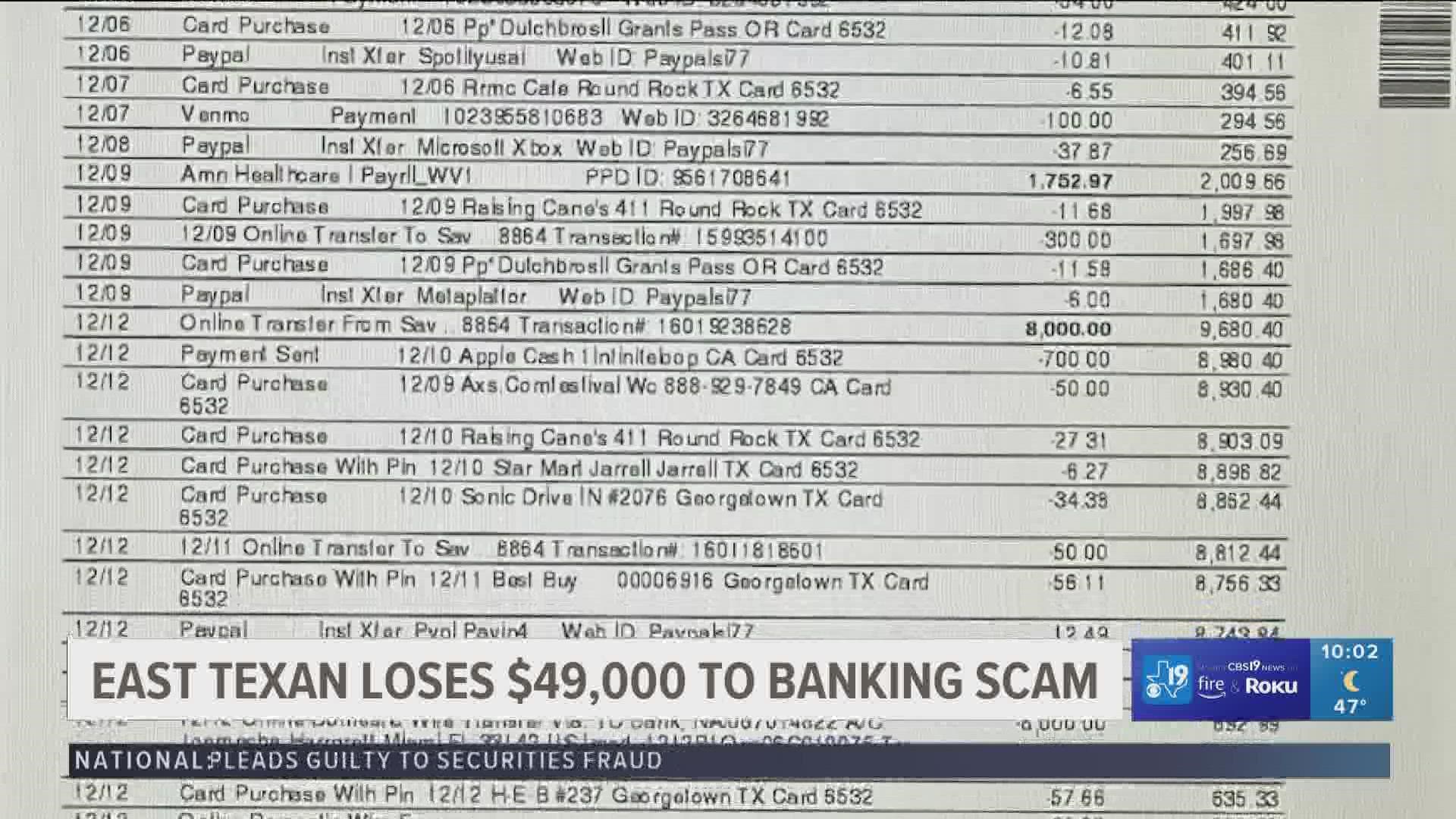

They asked for his personal information to make a new Chase Bank account to wire his money into. After a week went by, he called that same number back to ask about the fraud situation. The bank answered the call but said the new account he set up was not there anymore -- leaving him out $49,000 without a hint of where it went.

Mechele Mills, the president and CEO of the Better Business Bureau in Central East Texas says scam calls that match your bank’s information are not uncommon.

"This kind of fraud kind of falls into the category of imposter scams," said Mills. "That's just a really big scam right now."

According to the Federal Trade Commission’s 2021 Consumer Sentinel Network Data Book more than 2.9 million fraud reports were reported including imposter scams. With young people reported losing money to fraud more often than older people.

"This is how they make their money so they're just moving throughout the country just doing these types of things," said Mills. "Just targeting different areas at a time or everybody at one time because with technology you can contact millions of people."

"I feel like Chase is just like they don't care," said Pineda. "They're just trying to sweep it under the rug and move on and it's their fault this happened. I just want to get my life back because it's gone."

Pineda says he’s been having to rack up debt on credit cards to continue paying bills but thankfully this isn’t the end of his story. He says he finally got a call back from a legitimate a Chase Bank associate who plans to review his case and call him up with an update.

CBS19 also reached out to the bank via email for a statement on Pineda’s situation. As of Thursday, Jan. 19, we haven't gotten a response.