SMITH COUNTY, Texas — The pandemic has affected us all in many ways, especially when it comes to spending money.

Smith County’s proposed budget is a reflection of the tough times brought on by COVID-19.

"What we're trying to do in this next year’s budget is to say to the folks in the county, we are there with you and we're going to make some very tough decisions this year to cut back where we can cut back," said Smith County Judge Nathaniel Moran.

The county has spent the summer working on the Fiscal Year 2020-2021 budget and a proposed property tax rate, which seeks to lower that rate from its current amount.

“Our proposed tax rate this year is going to be 0.00335 cents (per $100 valuation), which is a full penny below the 0.00345 cents that we had for last year,” Judge Moran explained. “We know other people are hurting as well and we need to provide property tax relief to them."

Moran said the decrease is expected to be about half a cent below the No-New-Revenue Rate, also known as the effective rate.

“The effective rate basically says let’s look at the same property as last year compared to this year and determine if even with the increase in valuation, which occurs through the appraisal district which is not a part of Smith County,” Moran said. “Even with that evaluation are you going to bring in the same amount of money based on those same subset of properties, that’s the effective rate.”

The tax cut would bring in less revenue for the county for current properties, but it will see additional money from new property developments.

Property taxes make up a large percentage of the county’s money for its budget as well as sales tax revenue and fines and fees.

“Sales tax revenue and fines and fees both of those are down significantly as is interest,” Judge Moran explained. “And so we've put back a lot of needed projects till future years to try and cut our expenses this year.”

The Proposed Budget includes, among other things:

- Delays the previously planned bond election for a new Courthouse, originally planned for November 2020;

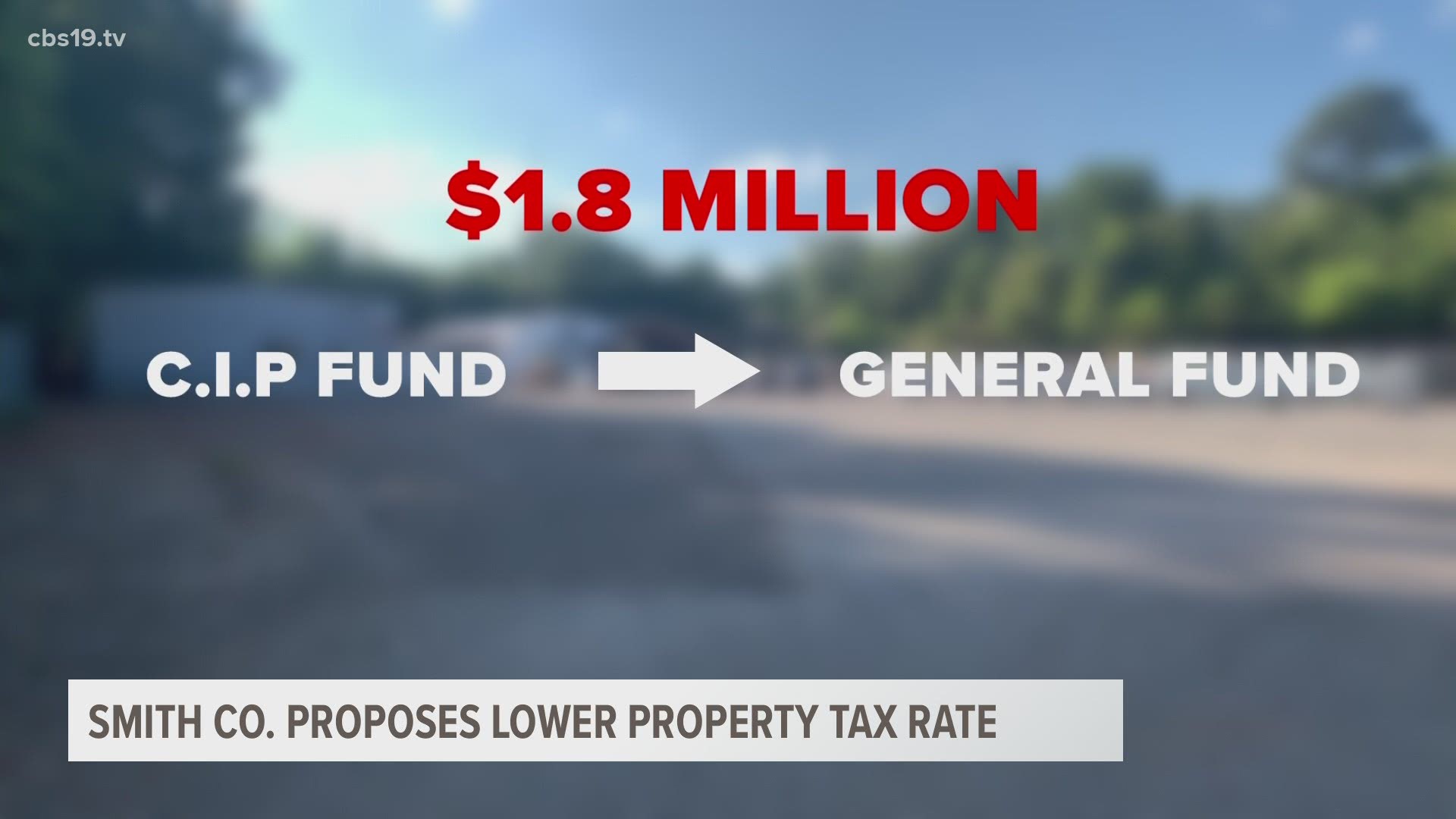

- Transfers $1.8 million from the Capital Improvement Projects Fund to the General Fund to cover the decreases in revenue;

- Uses $2.2 million from the Road and Bridge Department Fund Reserves to support continued FY 2021 Road and Bridge maintenance and operations to ensure that the priority on infrastructure is not affected;

- Cuts a number of general operating expenses under local control;

- Reduces fleet expenditures from $1.2 million to under $400,000; and

- Reduces the number of total employees in the County, by eliminating a variety of positions, while reclassifying other positions to cover new needs in the Sheriff’s Office and Office of the District Attorney.

The Smith County Commissioners will vote on the budget during the Aug. 25 meeting at 9:30 a.m. in the Courthouse Annex Building.

“We want to provide people the opportunity to give us input,” Moran said. “So anytime anybody wants to talk to us about the budget we invite them to come down they can do so during the public participation time of our meeting even without it being set on the meeting, they can come give us some input."