TYLER, Texas — The COVID‐19 pandemic has significantly disrupted the supply chain and normal circulation patterns for U.S. coin resulting in a nationwide coin shortage.

According to a local fast food restaurant, that shortage is now affecting East Texas.

RELATED: There is a nationwide coin shortage

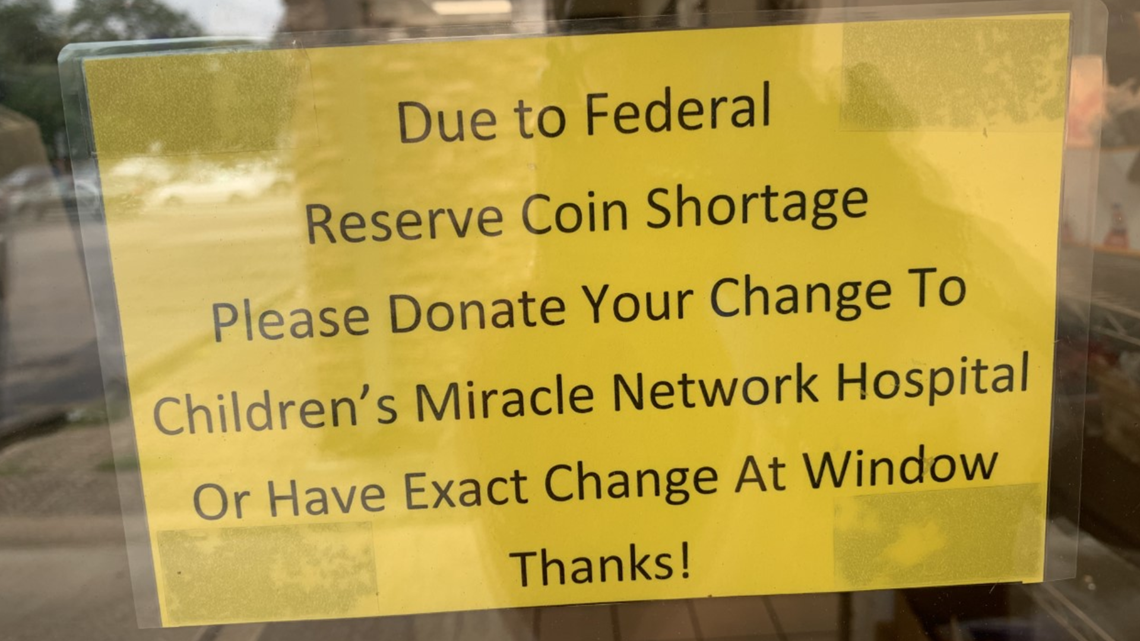

Dairy Queen, located near the intersection of ESE Loop 323 and Paluxy Drive in Tyler, has a sign on their door asking customers to donate change to the Children's Miracle Network or pay with exact change.

Dairy Queen tells CBS19, they have posted the sign pictured above at multiple East Texas DQ locations.

Some businesses across the state are also encouraging patrons to pay with debit/credit cards.

"In the past few months, coin deposits from depository institutions to the Federal Reserve have declined significantly and the U.S. Mint’s production of coin also decreased due to measures put in place to protect its employees," the Federal Reserve said in a statement. "Coin orders from depository institutions have begun to increase as regions reopen, resulting in the Federal Reserve’s coin inventory being reduced to below normal levels. While the U.S. Mint is the issuing authority for coin, the Federal Reserve manages coin inventory and its distribution to depository institutions (including commercial banks, community banks, credit unions and thrifts) through Reserve Bank cash operations and offsite locations across the country operated by Federal Reserve vendors."

We all know the mountains of loose change are probably better in your bank account than your pocket. So, what can you do with your coins?

According to the U.S. Treasury, there is no Federal statute mandating a private business, a person or an organization must accept currency or coins as for payment for goods and/or services. Private businesses are free to develop their own policies on whether or not to accept cash unless there is a State law which says otherwise. For example, a bus line may prohibit payment of fares in pennies or dollar bills. In addition, movie theaters, convenience stores and gas stations may refuse to accept large denomination currency (usually notes above $20) as a matter of policy.

Lifehacker.com reports the following banks have coin policies in place:

- U.S. Bank (no rolls, but customers only)

- Bank of America (requires coin rolls)

- Citibank (requires coin rolls, and may charge fees in some states)

- Chase (requires coin rolls)

- Credit Unions (requirements vary)

If you want to use a coin counting kiosk to turn your change into cash, you can find one near you at Coinstar.com.

However, keep in mind, an 11.9% service fee applies, but fees may also vary by location.

"To ensure a fair and equitable distribution of existing coin inventory to all depository institutions, effective June 15, the Federal Reserve Banks and their coin distribution locations began to allocate available supplies of pennies, nickels, dimes, and quarters to depository institutions as a temporary measure," the Federal Reserve said. "The temporary coin allocation methodology is based on historical order volume by coin denomination and depository institution endpoint, and current U.S. Mint production levels. Order limits are unique by coin denomination and are the same across all Federal Reserve coin distribution locations. Limits will be reviewed and potentially revised based on national receipt levels, inventories, and Mint production."